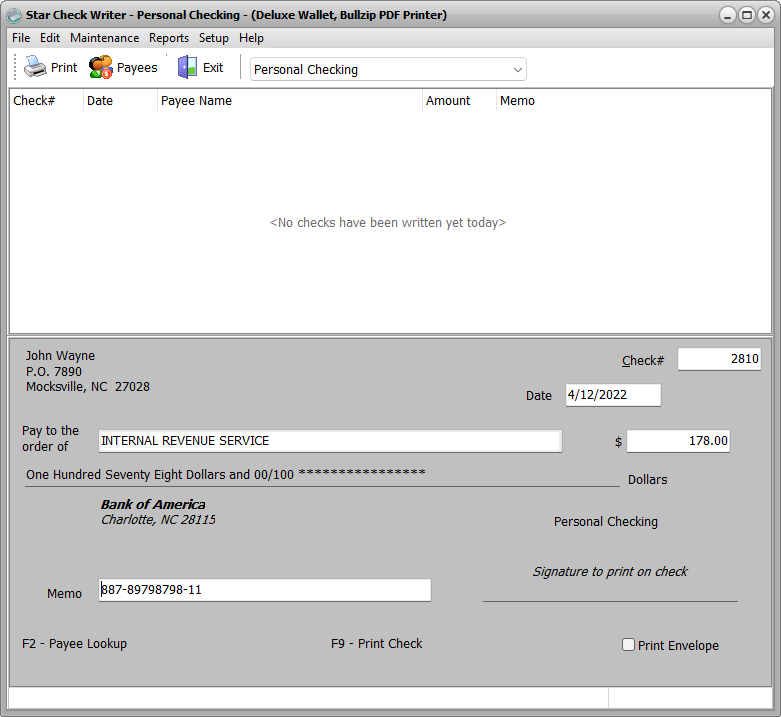

Starting as low as $69 per installation for a single-use for the QuickBooks compatible version ( ezCheckPrinting single user plus Virtual Printer), ezCheckPrinting makes professional looking checks and automated check writing accessible to any size business. Export and import of check data for use with ezTimeSheet, Excel file, QuickBooks, Microsoft Money, and other accounting software. Save time by printing multiple checks with one click Customizable report features that are easy to use Include signature image on checks to save time signing checks Use blank check stock or pre-printed checks in check-on-top, check-in-middle, or check-on-bottom formats

Prints MICR characters accepted by most banks (for use with laser printers) - no need to order expensive checks pre-printed with bank information No limit to the number of accounts that can be used Easy to use and learn, even for people who don’t have an accounting or IT background Add a company logo and other customizable design features for a professional, corporate look to company checks Some of the features included at no additional cost are: Potential customers can download and test drive ezCheckPrinting software before purchase with no obligation at ezCheck.asp With ezCheckPrinting software, customers can design and print professional-looking check in house easily. With the newest version of ezCheckPrinting Virtual Printer and EzCheckprinting bundle for QuickBooks with the updates to support QuickBooks 2016 online version, desktop version and previous versions.

(), has made great strides in producing easy to use and less expensive alternatives to business check writing. We are happy to say that ezCheckPrinting check writer is now helping thousands of businesses run more efficiently.” Said Dr. Instructions on who needs to adjust interest and how to calculate are available by clicking the blue “Help me figure this out” link.“ We have released ezCheckPrinting software in response to QuickBooks 2016 desktop and online customers’ requests. The Adjusted amount cannot be larger than the original amount or you will receive an error when trying to file. On the following screen, you will see the “Original amount”.Įnter the amount you can claim as a Home Mortgage Interest deduction in the “Adjusted amount” box. Next screen asks “Do any of these situations apply to you?” Select “Yes, one or all of these situations apply to me.” and Continue. Scroll down the “Here’s your 1098 info” screen and click Done. Scroll down to “Mortgage Interest and Refinancing (Form 1098)” Click Edit/Add Please go back to the Home Mortgage Interest section: If you don't see this screen, your interest is not limited. When you click "Done" on this screen, you should get to the “Do any of these situations apply to you?” screen. Are you getting an error that the interest you entered may be limited?ĭo you get to the "Here's your 1098 info" screen?

0 kommentar(er)

0 kommentar(er)